The CBD and cannabis industry is rapidly growing and constantly evolving markets, with new products and companies popping up all the time. However, despite its growth, these industries are still considered fragile, as they are vulnerable to market fluctuations and regulatory changes. The legal status of CBD is still somewhat uncertain, as it is not yet fully regulated by the federal government in the United States. This can make it difficult for companies to operate and for consumers to trust the products they are buying. Furthermore, the industry is filled with a diverse group of players with different interests, which can make it difficult to establish industry standards and best practices.

In this blog, Craig Henderson will reflect on the current state of the CBD industry through questions and content from a team member. He will explore some of the trends and insights that are shaping its future.

FDA Studying CBD? | What do you think the FDA will decide?

Overview: The Food and Drug Administration (FDA) is currently investigating the safety of legal cannabis in food or supplements and plans to make recommendations on how to regulate the increasing number of cannabis-derived products in the near future. According to FDA Principal Deputy Commissioner Janet Woodcock, given the current knowledge about the safety of CBD, the FDA has concerns about whether the existing regulatory pathways for food and dietary supplements are suitable for this substance.

Craig: It seems that the FDA’s investigation into the safety of cannabis in food and supplements may result in strict regulations, which could limit the availability of cannabis-derived products and hinder their growth in the market. The FDA’s concerns about the safety of CBD raise doubts about its potential benefits and call into question the adequacy of current regulatory frameworks. This could lead to a negative impact on the industry and the consumers who rely on these products.

New Markets Up, Old Markets Down | Do you think the Cannabis industry trends reflect on the CBD industry

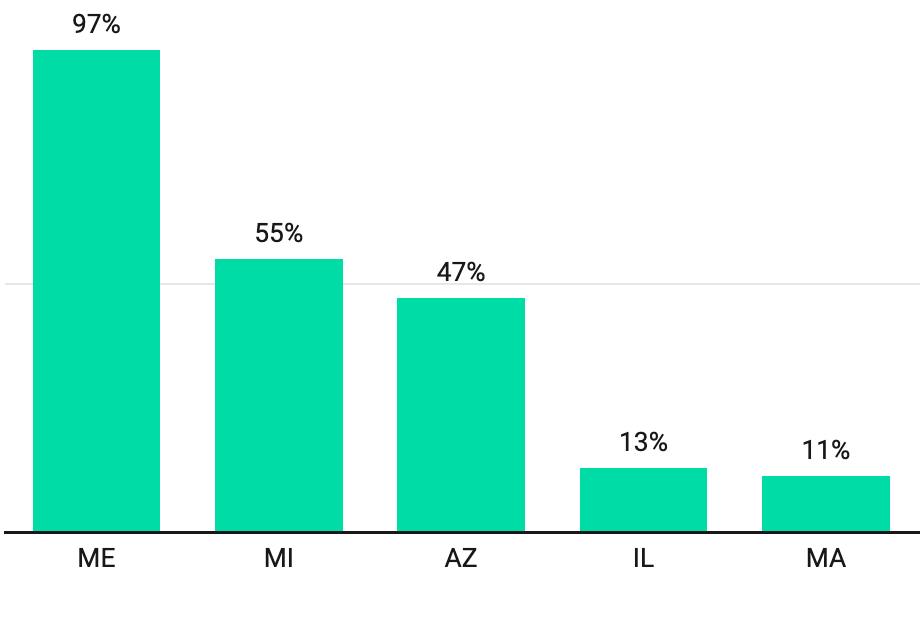

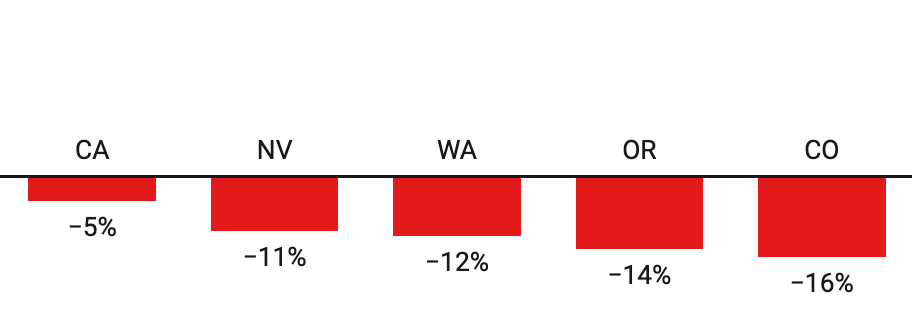

Overview: In 2022, the cannabis industry faced a decline in sales in mature recreational markets such as California, Nevada, Washington, Oregon, and Colorado. Many of these states saw double-digit drops in comparison to the previous year. Colorado, the first state to sell licensed recreational marijuana in 2014, experienced the worst downturn yet, with month-over-month sales steadily decreasing and lower wholesale flower prices.

Craig: The decrease in sales in mature recreational cannabis markets such as California, Nevada, Washington, Oregon, and Colorado can be attributed to several factors, including the recent decline in cannabis tourism, market saturation, increased competition, and a shift in consumer preferences towards alternative consumption methods like edibles and concentrates. The current economic recession has also played a role, with consumers limiting their spending on non-essential items, including travel and cannabis products. Despite these challenges, the cannabis industry has experienced growth in newer markets, like Maine, Michigan, and Arizona. The differing sales trends in mature and emerging markets highlight the need for established players in the industry to be agile and adapt to changing consumer demands, as well as present opportunities for growth and innovation in the newer markets.

State and Federal Disconnect

Overview: In early 2022, the DEA clarified that cannabis containing less than 0.3% THC is legal under the 2018 Farm Bill. The news was met with mixed reactions in the industry, as licensed growers and breeders have faced difficulties selling and acquiring genetics under strict regulations in some states. The DEA’s letter has created a state-federal disconnect and raised questions about the legality of non-licensed cannabis growers or breeders selling seeds, leading to confusion over how to navigate the cannabis genetics market under uncertain regulatory environment.

Craig: The DEA’s clarification that cannabis containing less than 0.3% THC is legal under the 2018 Farm Bill created both opportunities and challenges for those in the cannabis industry. On one hand, licensed growers and breeders were relieved to have a clearer understanding of the legal status of their products, but on the other hand, the state-federal disconnect raised questions about the legality of non-licensed growers or breeders selling seeds. This created confusion in the cannabis genetics market and added to the challenges faced by industry participants in navigating an already uncertain regulatory environment. The DEA’s clarification highlights the ongoing need for clear and consistent regulation in the industry, as well as the importance of staying informed about changes in the legal landscape.

What are your Overall Current Thoughts on the Industry Today?

Craig: The CBD industry today presents both opportunities and challenges. On the one hand, there is growing public awareness and interest in alternative wellness products, which has fueled demand for CBD, and this trend is expected to continue in the coming years. The industry is also attracting investment from major players, which will drive the development of new and innovative products, as well as improvements in manufacturing and distribution processes. Furthermore, there is growing recognition of the potential therapeutic benefits of CBD, and ongoing research is likely to uncover new uses for this versatile substance.

On the other hand, there is a lack of regulatory clarity and consistency, which has resulted in confusion and unpredictability for both consumers and industry participants. The industry is also plagued by a high degree of misinformation, with many companies making unsupported health claims about their products, which undermines consumer trust and complicates efforts to establish industry-wide standards. The current market is also heavily fragmented, with numerous small players and limited economies of scale, which has led to low barriers to entry and a proliferation of substandard products.

Despite these challenges, the CBD industry today is poised for significant growth and innovation, and as regulations continue to evolve and mature, the industry will have the opportunity to establish clear and consistent standards, which will help to build consumer trust and confidence. It’s important to approach the CBD industry with both a realistic understanding of its current challenges, as well as an optimistic outlook towards its future potential.

Where do you Think the CBD Industry is Heading? Any Concerns, Gratitudes, or Recommendations?

Craig: Based on current trends, I believe the CBD industry is headed towards continued growth and expansion over the next 5 years. As public awareness and interest in alternative wellness products continues to increase, there will be a growing demand for CBD products, which will drive industry innovation and the development of new and diverse products. The increasing recognition of the therapeutic benefits of CBD, as well as the ongoing research into its potential uses, will also contribute to the industry’s growth.

However, in order to fully realize its potential and overcome current challenges, the CBD industry must focus on establishing clear and consistent regulations and standards, which will help to build consumer trust and confidence. Companies in the CBD industry should also prioritize transparency, including clearly labeling their products and providing accurate and science-backed information about their ingredients, as well as investing in research and development to create high-quality, safe and effective products. Additionally, companies must adapt to changing consumer preferences and market conditions, by offering a range of innovative and diverse products that meet their needs.

In conclusion, the next 5 years will likely be a time of growth and expansion for the CBD industry, and companies that focus on regulation, transparency, innovation, and consumer needs will be well-positioned to succeed.

Closing Thoughts

Craig: The cannabis and CBD industries are dynamic and rapidly evolving, with many challenges and opportunities ahead. Despite setbacks and regulatory hurdles, the overall trend is one of growth, innovation, and increasing recognition of the benefits of cannabis and CBD products. Companies and individuals within these industries must stay informed, be adaptable, and prioritize transparency, regulation, and consumer needs in order to succeed and make a positive impact in the years to come. With the right approach, the future of the cannabis and CBD industries looks bright, offering the potential for improved health, wellness, and economic benefits for individuals, communities, and society as a whole.